Irs rental property depreciation calculator

Depreciation - Life of AssetTo determine the classification of property being depreciated whether it is 3-year property 5-year property etc refer to IRS Instructions for. According to the IRS.

Increase The Rate Of Return With Cost Segregation Tax Reduction Income Tax Study Help

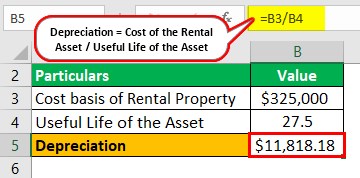

The IRS considers the useful life of a rental property to be 275 years so the amount of depreciation you can claim each year is your propertys value divided by 275.

. IQ Calculators provides a free rental property calculator for its site visitors that automatically calculates depreciation. MACRS Depreciation Formula The MACRS Depreciation Calculator uses the following basic formula. To find out the basis of the rental just calculate 90 of 140000.

How to Calculate Depreciation on Rental Property. It is determined based on the depreciation system GDS or ADS used. 1 Best answer.

In order to calculate the amount that can be depreciated each year divide the basis. Since you spread the depreciation deduction over 275 years you take the cost basis of the building not the land and divide it by 275 years to calculate your annual. This rental property calculator allows the user to enter all.

1st year depreciation 12 month 05 12 cost basis recovery period As you can see the only part of this formula that is different from the standard straight-line depreciation method is. 415 Renting Residential and Vacation Property. To take a deduction for depreciation on a rental property the property must meet specific criteria.

You must own the property not be renting or borrowing. A rental property depreciation calculator can be a great tool for investors looking to find out the depreciation on their rental property. Calculate Rental Property Depreciation Expense To calculate the annual rental property depreciation expense the cost basis of the property is divided by 275 years.

It provides a couple different methods of depreciation. The recovery period of property is the number of years over which you recover its cost or other basis. D i C R i Where Di is the depreciation in year i C is the original purchase price or.

First one can choose the. Website 5 days ago IRS has precise rules to determine the propertys useful life and depreciation. June 7 2019 308 PM.

Generally depreciation on your rental property is the based on the original cost of the rental. Depreciation in real estate is basically a tax. If you receive rental income for the use of a dwelling unit such as a house or an apartment you may.

Depreciation Calculator This depreciation calculator is for calculating the depreciation schedule of an asset. A rental property owner needs to. The result is 126000.

Rental Property Depreciation Rules Schedule Recapture

Determining Holding Period Upon Sale Of Rental Real Estate Dallas Business Income Tax Services

Residential Rental Property Depreciation Calculation Depreciation Guru

Super Helpful List Of Business Expense Categories For Small Businesses Based On The Sc Small Business Bookkeeping Small Business Tax Small Business Accounting

Schedule E Disposition Of Rental Property Schedulee

Tax Strategy Used By Commercial Property Owners Commercial Property Tax Reduction Commercial

Depreciation Recapture What It Is How To Avoid It In 2022 Capital Gains Tax Irs Taxes Savings Strategy

How You Can Make Money From Your Rental Show A Loss On Your Tax Return Semi Retired Md

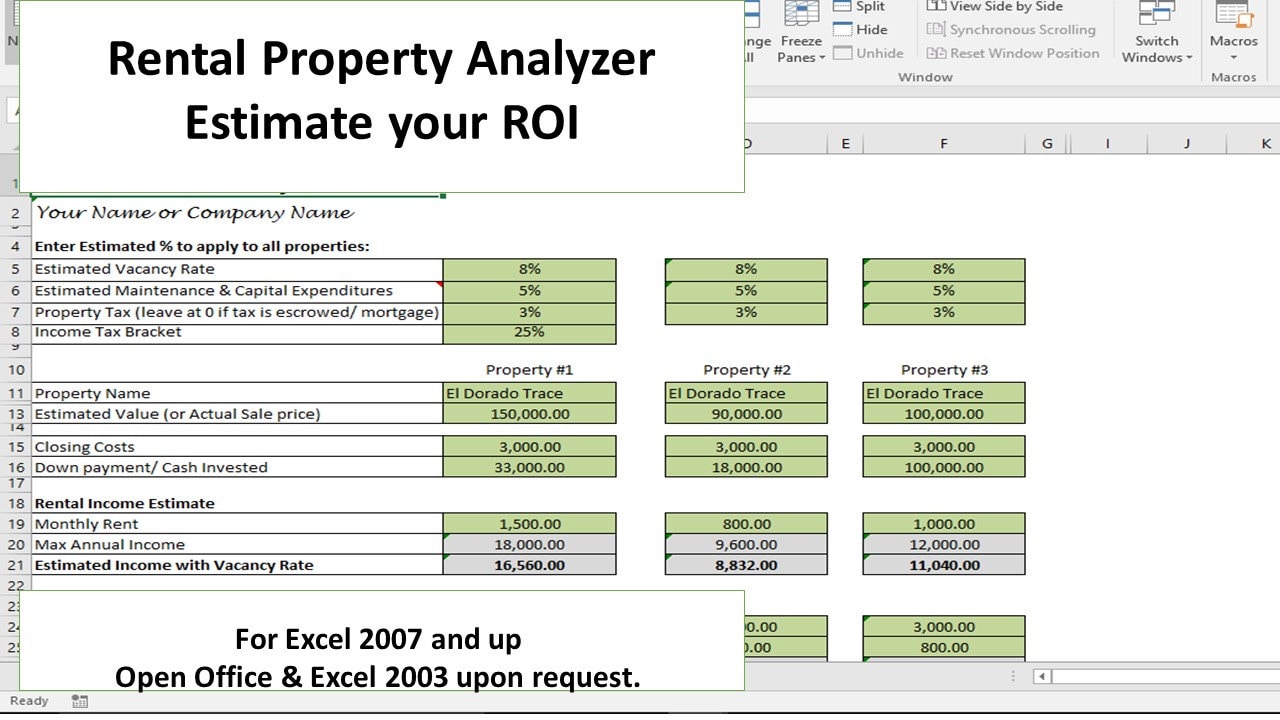

Investment Property Analyzer Rental Property Calculator Etsy

How To Use Rental Property Depreciation To Your Advantage

Depreciation For Rental Property How To Calculate

Rental Property Depreciation Rules Schedule Recapture

What Is Bonus Depreciation In 2022 Tax Reduction Bonus Net Income

How To Calculate Depreciation On Rental Property

How To Fill Out Schedule E Rental Property On Your Tax Return Youtube

Residential Rental Property Depreciation Calculation Depreciation Guru

The Sales Proceeds Calculation Home Mortgage Real Estate Investing Rental Property